tax lien sales colorado

Tax sale certificates can provide steady returns when managed properly. When the sales tax is remitted you can debit the sales tax payable and credit cash.

Colorado Tax Lien Auctions News With Stephen Swenson Of Tax Sale Support Learn About How Colorado Tax Lien Work And How Investing Ebook Series Training Video

States and Washington DC.

. The procedure for applying this tax is similar to that used for real property. Accomack County Contact Info. A federal tax lien is the governments legal claim against your property when you neglect or fail to pay a tax debt.

The IRS is required by law to pay interest on tax refunds due to individual taxpayers affected by the federally declared disaster. A tax lien property has a legal claim against it due to unpaid property taxes. Sales tax is reported in a journal entry.

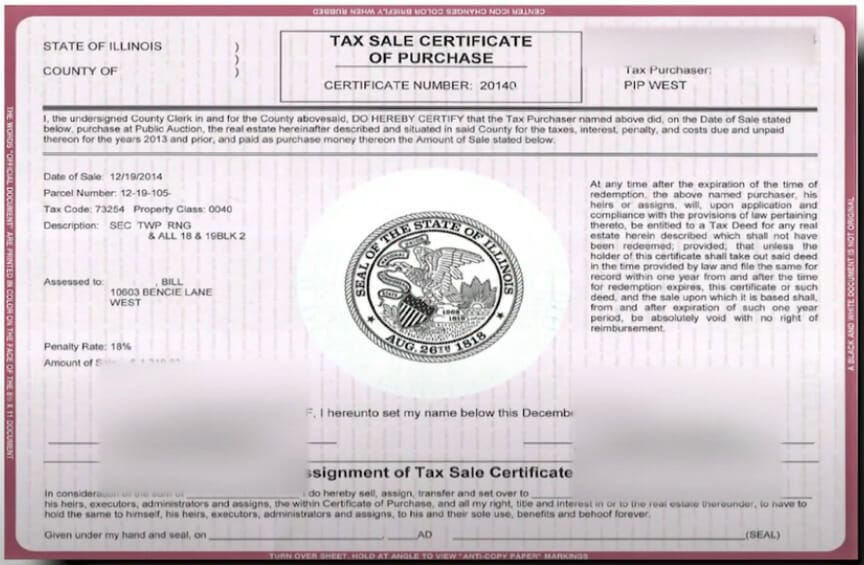

Many individual taxpayers whose 2019 tax returns show refunds will receive interest from the IRS. Purchasing delinquent tax liens at sale is a popular form of investment. Upon request of the certificate holder for a tax deed sale the certificate is forwarded to the Clerk and a Tax Deed Sale is held.

Please check back for more information. A tax lien is placed on every county property owing taxes on January 1 each year and remains until the property taxes are paid. Frequently Asked Questions for Vehicle and Watercraft Dealers - Including dealer documentation requirements dealer-to-dealer sales issues sales tax for out-of-state transactions and more.

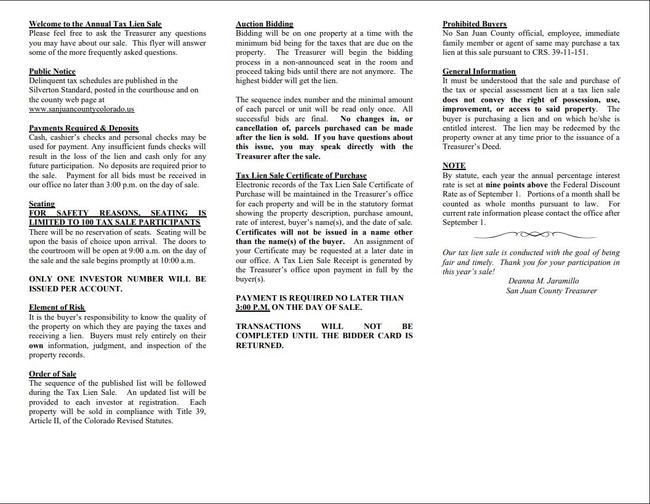

View Tax Sale Information for detailed instructions on how the online tax lien sale works. For Tax Lien Buyers Bidders The 2021 Tax Lien Sale will be held online on a date TBA. Sales tax is a consumption tax meaning that consumers only pay sales tax on taxable items they buy at retail.

Colorado has a penalty for failing to pay sales tax on time of the greater of 10 of the sales tax due plus 05 of the tax due per month maximum 18 or 15. Have access to the foreclosed property. Its important to know the individuals or companies you do business with.

If youre interested in tax lien investing the first step is finding tax liens for sale at auction. For additional information regarding tax lien sales call 7205236160. Colorado has a penalty for failing to file sales tax returns on-time of 10 of the sales tax due plus 05 of the tax due per month maximum 18 or 15.

As an investor you can purchase a tax lien. Here are some facts to help you understand what a tax lien sale investment is and is NOT. If a lien is wrongfully sold the County must pay the certificate holder the accrued interest.

Since businesses collect sales tax on behalf of tax authorities tax cannot be recorded as revenue. The lien protects the governments interest in all your property including real estate personal property and financial assets. What you dont know CAN hurt you.

Accomack County Treasurer 23296 Courthouse Ave Accomac VA 23301 Phone 757787-5738 Fax 757787-3238. Read More Here are the Upcoming Online Foreclosure Auctions for the week of 4-26-21. El Paso County officials or employees or their immediate family or agents may not participate in the purchase of liens.

Sales tax is a small percentage of a sale tacked on to that sale by an online retailer. Albemarle County Contact Info. Updated Motor Vehicle Dealer Rules.

The tax lien sale is the final step in the treasurers efforts to collect taxes on real property. There are two types of tax sale homes. Once you know when a tax lien auction is scheduled you can plan to attend.

Tax Certificates are sold yearly by the Tax Collector on properties with delinquent taxes. Have information regarding liens on foreclosed property contact the Clerk and Recorder at 520-6200. Handle Tax Sales contact the County Treasurer at 719-520-7900.

Heirs with rightful claim to the property should maintain the taxes to avoid additional penalties fees or it potentially going to a tax sale. Tax lien sales and tax deed sales are only conducted in select states and jurisdictions some doing one or the other while other states use a hybrid of both. Both represent sales of homes with unpaid property taxes.

The accounting entry for sales involving sales tax will look like this. Contrary to most claims by Internet and infomercial gurus you should never expect a 100 60 or. Handle Federal Auctions such as HUD or VA.

Sales Tax and SaaS Accounting. The regular April 15 due date for filing returns and paying income taxes was postponed to July 15 2020 as part of the IRS response to the COVID-19 pandemic. A tax sale is the forced sale of property usually real estate by a governmental entity for unpaid taxes by the propertys owner.

All have a sales tax. For any questions about Tax Lien Sales please contact our office. If the property owner does not pay the property taxes by late October the county sells the tax lien at the annual tax.

Tax lien sale homes and tax deed sale homes. A tax lien sale is when the liens are auctioned off. Motor vehicle dealers must use Indiana sales tax return ST-103CAR through INTIME or another approved filing.

If the IRS timely refiles the tax lien it is treated as continuation of the initial lien. The Colorado Business Personal Property tax is a levy on Business Personal Property used in a business or organization. Your local tax agency may be able to provide information on when tax lien auctions take place according to the National Tax Lien Association NTLA.

When a property has a tax lien it cannot be sold or refinanced until the taxes are paid and the lien is discharged. Main Street Room 203 Clinton TN 37716 Phone. The Treasurer then mails a tax bill to the property owner.

The sale depending on the jurisdiction may be a tax deed sale whereby the actual property is sold or a tax lien sale whereby a lien on the property is sold Under the tax lien sale process depending on the jurisdiction after a specified period of time if. The refiled tax lien will be valid for the extended timeframe the IRS has to collect it is good for. The Tax Lien Sale Site is open for registration year-round.

The Assessor estimates a value for the property and consolidates the levies. Vehicle and Watercraft Information. Tax lien sale certificates refund checks redemption checks and 1099 interest forms are prepared from this information.

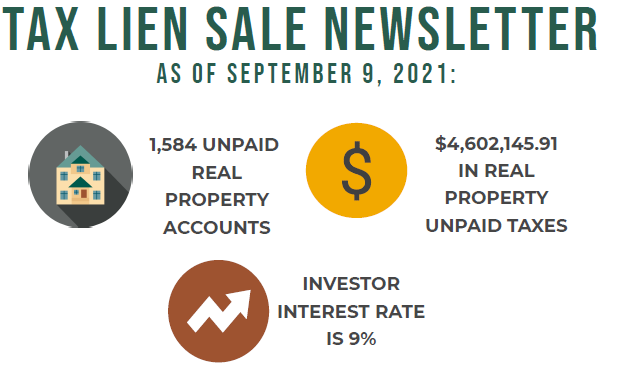

The 2021 Internet Tax Lien Sale will be held on November 4 2021 2021 Tax Lien Sale Interest Rate is 9. Taking a property through a tax deed sale. Anderson County Trustee 100 N.

Find Foreclosures and Tax Lien Sales Resources in Virginia. The rate will be 8 per annum for the delinquent tax liens sold this year. Tax sales and more specifically tax deed sales are not as complicated as you may first believe.

County Records are a vital source for Adverse Liens aka Involuntary Liens such as. Release private trustee mortgage transactions. The tax lien will still expire at the end of 10 years even if the IRS has more than 10 years to collect unless the IRS timely refiles the lien.

The 2021 Florida Tax Certificate Sale season is once again upon us and Realauction is pleased to host the tax lien sales for multiple Tax Collectors throughout the state.

What Is A Property Lien This Debt Could Trip Up Your Home Sale Real Estate Investing Home Buying Capital Gains Tax

Tony Martinez Asks If You Have Considered The Possibility Of Purchasing An Investment Property With An Existing Tenant Discover Investing Tax Mortgage Payoff

Tax Lien Investing Pros And Cons Youtube

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Secrets Of Tax Lien Investing Tax Sale Investment Type Tax Lien States Tax Deed States And Redemption Deed States Tax Help Tax Prep Investing

16k Tax Lien On 1 500 000 Storage Units Colorado Tax Liens Online Auction Review Youtube

Tax Lien Foreclosures On Properties Due To Nonpayment Of Property Tax Are Common Nowadays Foreclosures Buying A Foreclosure Avoid Foreclosure

Colorado County Treasurers And Public Trustees Associations

Tax Lien Investing Is A Game Even Hedge Funds Can Like The Denver Post

Tax Lien Truths The Mountain Jackpot News

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Tax Liens The Complete Guide To Investing In New Jersey Tax Liens Paperback Overstock Com Shopping The Best Deals On G Investing Books Bestselling Books

Tax Lien Information Larimer County

Tax Deed And Tax Lien Investing Ebook

Investing In Tax Liens The Rate Of Return Ash Mcginty Co Realtors